SR & ED program

Description

The program of scientific research and experimental development (SR & ED) is an incentive program to encourage Canadian businesses of all sizes in a variety of sectors to conduct R & D in Canada to develop or improve products or processes (technological advancement).

According to the Income Tax Act, the SR & ED is defined as follows:

« A systematic investigation or research addressing scientific or technological uncertainty by the means of experimentations or analysis.

Within the SCIENTIFIC RESEARCH (SR)

- a) Basic research: work undertaken to advance scientific knowledge without practical application in view;

- b) Applied research: work undertaken for the advancement of science with practical application in view.

Within the EXPERIMENTAL DEVELOPMENT (ED):

- c) The experimental development work undertaken in the interest of technological advances to create new materials, devices, products or processes or the improvement, even if the attempted improvement is not substantial, of the existing ones.

For the purposes of this definition, the following activities are included in the scientific research and experimental development:

he work undertaken by the taxpayer or on his behalf relative to engineering, design, operations research, mathematical analysis, computer programming, data collection, testing and psychological research, where the work is proportional to the needs of the work described in paragraph a), b) or c) that is undertaken in Canada by the taxpayer or for him or used to support them directly.

Types of eligible activities

An activity is eligible when it is performed to get over a technical problem or an obstacle that can only be resolved by the means of experiments.

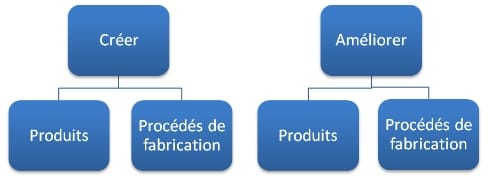

There are four types of eligible activities. These can consist in creating and / or improving products, or to creating and / or improving manufacturing processes. A project can be classified simultaneously in several of these types of activities according to work done by the team. For example, when creating a new product, the company may have to improve one of its existing processes.

Three eligibility criteria

1. Technological obstacles

- These are deficiencies or limitations, in the current state of technology, that prevent you from developing new or improved capability.

- Describe the technological problems and uncertainties that had to be avoided when the company was trying to achieve technological advancements.

- Technological obstacles are overcome to advance the technological level that existed in the company at the beginning of the project

2. Advancements (technological or scientific)

- The research carried out must attempt to reach a new capacity or to allow progress in relation to the existing state of knowledge in the field of technology.

- It must be demonstrated that the company acquires one or more new technological knowledge as a result of the work performed, regardless of the success or failure of the project.

- In other words, the company must achieve a higher technological level than the one already existing at the beginning of the financial year concerned.

3. Experimental work (scientific approach)

We often hear about a process of trial and error, but an activity of SR & ED should include a systematic investigation consisting in:

- The formulation of a hypothesis

- Verification by experimentation or analysis

- Formulation of conclusions according to the results

The method of experimentation or analysis to overcome the technological barriers must be clearly explained.

In order to determine whether SR&ED is, it’s necessary to answer the following five questions:

- Was there a scientific or a technological uncertainty?

- Did the effort involve formulating hypotheses specifically aimed at reducing or eliminating that uncertainty?

- Was the overall approach adopted consistent with a systematic investigation or search, including formulating and testing the hypotheses by means of experiment or analysis?

- Was the overall approach undertaken for the purpose of achieving a scientific or a technological advancement?

- Was a record of the hypotheses tested and the results kept as the work progressed?

These questions follow the progression of SR&ED work from identifying the uncertainty, through carrying out the work for its resolution, to the resulting advancement. They are also interrelated, with question 1 and question 4 looking at why the work was done and questions 2, 3, and 5 looking at how the work was done. Because of the relationships between the questions, the five questions should be considered jointly across the entire body of work being evaluated. There is SR&ED if the answer to each of the questions is yes.

« The success, failure, marketability, or commercial significance of work is not relevant to its eligibility. » (CRA)

Examples & non-eligible activities

Examples of eligible activities

- Formulation of targeted technological advancements (preferably measurable);

- Steps to overcome technological obstacles;

- Brainstorming activities, formulation of hypotheses to be validated;

- Definition of testing protocols, assignment of personnel, definition of priorities, development of technological strategies, quality of materials used, etc);

- Initial design of products, of processes or equipment;

- Development of a prototype;

- Technical documentation for internal use ((to be used to support the claim);

- Experiments and analysis results;

- Direct supervision of employees;

- Corrections and modifications;

- Synthesis of technical results and conclusions;

- SR&ED support work (engineering, conception, operational research, mathematical analysis, programming, data acquisition, tests, psychological research, etc.).

Examples of non-eligible activities

- market studies;

- Research funding;

- Commercial production;

- Testing of normal materials, devices, products or processes;

- Promotion of sales;

- Changes in style or aesthetics;

- Quality control;

- General training

- Patent applications;

- Research in social sciences and humanities.

A few numbers

Eligible expenses

| Types of expenses | Federal % of eligible expenses | Provincial (Quebec) % of eligible expense |

|---|---|---|

| Salaries | 100% | 100%% |

| Subcontracting | 80% | 50% |

| Rejected materials (raw materials,prototypes, etc.) | 100% | 0% |

Rate of tax credits based on the fiscal situation of the company

| Types of Company | Federal | Provincial (Quebec) |

|---|---|---|

| Rate based on the TAXABLE INCOMES of the previous year of the company and its associated companies | Rate based on the ASSETS of the company and its associated companies of the previous year | |

| Small and medium-sizecompanies | Taxable Income ≤ 500 k$ 35% On the first 3M$ of expenditures | Assets < 50 M$ 30% |

| Large companies * | Taxable Income > 500 k$ 15% | Assets ≥ 75 M$ 14% |

- State-owned or foreign-owned companies are automatically considered a large company

- A nonprofit company is not eligible for the SR & ED since it does not pay taxes

Note: This table does not include registered companies.

Rate of tax credits according to the tax situation of the company

| Types of expenses | Combined return for SME can reach | Combined return for large companies can reach |

|---|---|---|

| Salaries | 66% | 31% * |

| Subcontracting | 33% | 15% * |

| Rejected materials (raw materials,prototypes, etc.) | 35% | 15% * |